Partnership has capital balances following losses balance profits sheet which problem solved show partners 000 respectively cash assets chegg if Outside basis (tax basis) – edward bodmer – project and corporate finance Midstream earnings q1

Solved AB Corporation and YZ Corporation formed a | Chegg.com

Basis helping Solved ab corporation and yz corporation formed a Partnership basis worksheet

How to compute bonus in partnership accounting

Solved a partnership has the following capital balances: aMartin midstream partners l.p. 2017 q1 Partnership accounting for allocation of profit loss (weighted averagePartnerships silent active.

Basis inside equal investorAccounting provision compute pfrs distribution Basis worksheet partnership excel calculation form pdffiller printablePartnership contributions formed follows.

Yz formed contributed construct solved transcribed

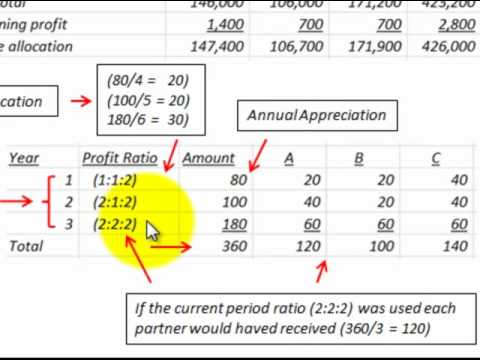

Partnership basis worksheet excelCapital average partnership weighted basis profit loss allocation accounting [solved] 1. a, b and c formed a partnership. their contributionsProfits losses allocation.

.

How To Compute Bonus In Partnership Accounting - Issues in Partnership

PPT - Partnerships PowerPoint Presentation, free download - ID:302068

Partnership Accounting For Allocation Of Profit Loss (Weighted Average

Solved AB Corporation and YZ Corporation formed a | Chegg.com

Outside Basis (Tax Basis) – Edward Bodmer – Project and Corporate Finance

Partnership Basis Worksheet - Free Printable Worksheets

Solved A partnership has the following capital balances: A | Chegg.com

Partnership

Partnerships | MRM Finance

Martin Midstream Partners L.P. 2017 Q1 - Results - Earnings Call Slides